It often starts quietly.

A CIO hears that their long-time IT channel partner has been acquired by a larger firm or private equity group. On the surface, nothing seems too different, the same account manager picks up the phone, the same logo appears on invoices.

But over the months, more impactful changes begin to creep in.

Projects stall. Pricing shifts without warning. Requests for help move slower through more layers of approval.

Unfortunately, these stories are becoming increasingly common.

Consolidation is reshaping the partner ecosystem, and the ripple effects are hitting organizations in ways that CIOs can’t always predict. The wrong partner, or even the right partner caught in the wrong acquisition, can quietly erode service levels, compromise OEM relationships, and introduce operational risk into critical IT initiatives.

Brian Hill, President and CRO of Imperium Data, has worked with CIOs across multiple industries and has seen the pattern play out many times.

“It happens more often than not,” he notes. “The service level starts to drop after an acquisition. If you’re not prepared for that, you’re reacting instead of leading.”

The good news?

Forward-thinking CIOs rethink their partner strategy before disruption strikes. They move beyond the traditional “vendor” mindset and seek channel partners who are both big enough to execute at the highest levels of business but also entrepreneurial enough to deliver enterprise-level results with the agility and commitment of a trusted advisor.

The Changing Technology Partner Market

The pressures behind these shifts aren’t random; they’re the result of a rapidly consolidating IT channel partner market. Over the last several years, midsize value-added resellers (VARs), managed service providers (MSPs), and systems integrators have increasingly been acquired by national brands or rolled up by private equity groups.

On paper, these deals promise efficiency, scale, and a stronger market presence.

In practice, however, the story can be different.

Private equity’s focus on driving margins often prioritizes cost-cutting over customer care. The personal service that drew a CIO to a partner in the first place can be diluted or lost entirely.

When a channel partner that once knew your environment inside and out becomes part of a billion-dollar portfolio, priorities change. Decision-making moves farther from the front lines. Account teams are restructured, sometimes multiple times. In some cases, the partner’s standing with key OEMs, the very relationships that underpin your IT strategy, can weaken.

Hill recalls one acquisition in particular:

“We watched a respected, privately held solutions provider get absorbed into a larger entity. Within months, pricing climbed, service slowed, and several of their customers came to us looking for help. We onboarded four or five in under eight months, a process that normally takes years.”

For CIOs, the takeaway is clear: the IT channel partner market is evolving whether you prepare for it or not.

Knowing where your partners sit in this changing ecosystem, and understanding how their business model, ownership, and OEM relationships affect you, is the first step toward safeguarding your service levels and strategic flexibility.

Blind Spots

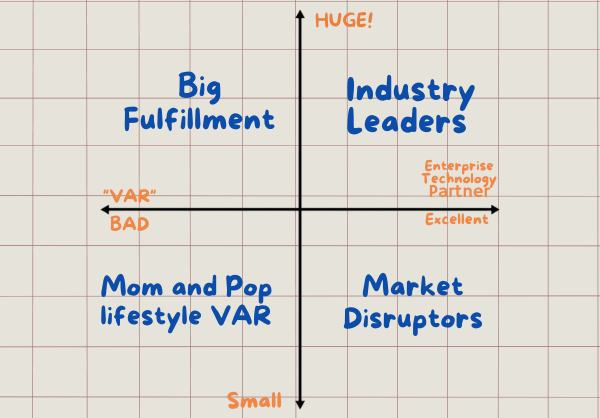

Even experienced technology leaders who understand the risks of consolidation can overlook one critical point: how they define and categorize their IT channel partners.

Too often, technology leaders slot partners into one of two buckets:

- Fulfillment VARs – companies that primarily sell hardware and software, with minimal involvement beyond the transaction.

- Integrators – firms that focus on professional services and implementations, often without selling the equipment they install.

This mental model feels logical, until it isn’t.

In practice, it can create blind spots that impact cost, efficiency, and project outcomes. Hardware purchased through an Integrator might be marked up multiple times before it’s installed. Implementation timelines can stall as work passes between different vendors. Accountability becomes blurred when one partner provides the gear and another performs the integration.

“There’s a misconception that you have to choose between a reseller and a services firm,” says Hill. “The truth is, the right channel partner can deliver both, and provide the strategic oversight to ensure every part of the project is aligned.”

When CIOs hold onto outdated definitions, they risk missing out on channel partners that can close these gaps, offering enterprise-level execution alongside the agility and responsiveness of a smaller, more entrepreneurial firm.

For innovative IT leaders, bridging that gap is a way to protect service quality, control costs, and maintain operational momentum in a changing market.

The Case for the Strategic Partner

The modern CIO needs more than a transactional vendor, they need a channel partner who can operate as an extension of their IT leadership team. This means covering the entire lifecycle: strategic planning, OEM negotiations, fulfillment, implementation, and ongoing optimization.

Hill calls this role an enterprise technology partner or channel partner.

“There is a lot of perceived career risk, especially within larger organizations, and we’ve seen CIO’s and Procurement leaders often not be aligned on what good looks like for the organization” he says. “Firms like ours execute at the same level as our $20 billion dollar competitors, but we add the nuance and responsiveness they can’t match, especially within the commercial and mid-market enterprise space.”

For many organizations in the $500 million to $5 billion revenue range, the challenge is finding a partner that is both:

- Big enough to execute – Capable of handling enterprise-scale deployments, managing complex OEM relationships, and delivering consistent project execution.

- Small enough to care – Nimble enough to adapt quickly, personally invested in the client’s success, and willing to engage deeply with internal teams.

This combination bridges the gap between the “white-glove” treatment large enterprises get from global providers and the agility that smaller, entrepreneurial firms bring to the table. It also removes the friction of juggling multiple vendors with competing priorities.

When done right, this strategic channel partnership transforms the role from a vendor to a trusted advisor, a partner who not only delivers the project but helps shape the roadmap.

Warning Signs After an Acquisition

When a trusted channel partner gets acquired, the first changes are rarely announced in an email. Instead, they surface gradually in the daily interactions your team has with theirs. By the time the service drop is obvious, the damage may already be done.

CIOs should be alert to early indicators, including:

- Slower response times – Approvals or decisions that once took hours now require days.

- Price creep – Subtle increases that add up over time.

- Team turnover – Account managers or engineers you’ve relied on suddenly disappear.

- OEM relationship changes – Your partner’s standing with key manufacturers declines, affecting pricing, availability, or even their ability to fulfill orders.

- Credit holds – If a manufacturer places your partner on credit hold, your projects can stall without warning.

Hill advises a proactive approach.

“If you know a vendor your organization works with has just been acquired, call the CIO or director of infrastructure right away. Ask if they’ve noticed any changes. That’s often where the real story comes out.”

By monitoring competitive changes, flagging risks, and helping you prepare alternatives before your service levels take a hit, the right strategic channel partner can be a competitive advantage to any organization.

How CIOs Can Protect Themselves

Acquisitions and market shifts are inevitable. The question is whether your organization is ready to adapt without losing momentum. CIOs can take practical steps to safeguard their channel partnerships:

- Talk to the OEMs directly – Ask your Cisco, Juniper, or HPE rep for their candid perspective on your partner.

- Evaluate partner certifications and standing – A partner’s OEM tier reflects technical investment, deal volume, and relationship strength.

- Require quarterly reviews – Use these to review project outcomes, upcoming needs, and strategic alignment.

- Map the full scope of services – Know whether your partner can handle every stage or if you’re splitting work across vendors.

- Develop a “Plan B” – Identify alternative partners before you need them, so you’re never negotiating under pressure.

Hill points to Imperium’s Juniper Elite Plus partner status as an example:

“We’re at the highest level of Juniper’s Global Partner Program. That means we have the same OEM relationship strength as companies 200 times our size, and our clients benefit from it.”

Real-World Success Stories

Tampa Bay Buccaneers – A Consultative Partner Beyond the Sale

The Buccaneers’ technology environment includes ongoing infrastructure needs and unique stadium projects. Even when Imperium isn’t the seller, such as purchases made through mandated contracts with other providers, they act as a trusted advisor.

When the team needed to assess hundreds of access points under stadium seats, Imperium coordinated third-party technicians, layered in project management, and delivered a complete report the CIO could take to the CFO.

“Imperium Data is a partner as well as a technology supplier. As an extension of our team, they have continuously delivered high-quality services and solutions for us to evaluate. Their knowledge and consultative style have enabled us to remain committed to innovation and provide our supporters with an outstanding experience, whether it is overseeing intricate stadium developments or assisting us in making important technological decisions.”

Charles Harris – Tampa Bay Buccaneers

West Florida Medical Center Clinic – Extending the IT Team

For a single-location, downtime can put patient care at risk. West Florida Medical Center Clinic turned to Imperium Data to act as an outsourced NOC, managing everything from the phone system to the Wi-Fi network.

This relationship evolved over a four-year sales cycle, building trust between Imperium’s engineering team and the hospital’s IT leadership. Today, Imperium responds immediately to outages, oversees nightly maintenance, and functions as an extension of the hospital’s internal staff.

“We have always been diligent about managing our IT services in-house, a commitment that becomes more challenging as we strive to keep pace with fast-moving, ever changing technology. Adding Imperium Data as a partner for IT management has been an incredibly positive step for our clinic. We are extremely satisfied with their services; their incredible response time and steadfast reliability have been particularly impressive, allowing us to focus on what matters most, our patients.”

Richelle Harrelson – Medical Management Services

The Bottom Line

In a market where acquisitions, roll-ups, and shifting priorities can disrupt service without warning, CIOs can’t afford to treat technology partnerships as static. They must continuously evaluate their partners on execution, agility, and commitment to the relationship.

The ultimate goal: build resilient, value-driven channel partnerships that deliver consistent execution, adapt to change, and create lasting competitive advantage.

As Hill puts it:

“Customer acquisition is really hard, and we’re grateful when we get new opportunities with forward thinking CIOs. In return, we stay committed to cultivating a customer experience that creates life-long customers and more advocates for value-driven partnership”

The message is clear: choose partners who match enterprise-level capabilities with the personal investment of a true advisor. Build those relationships before you need them.

And when market changes come, because they will, you’ll be ready, not scrambling.

Trusted insights for technology leaders

Our readers are CIOs, CTOs, and senior IT executives who rely on The National CIO Review for smart, curated takes on the trends shaping the enterprise, from GenAI to cybersecurity and beyond.

Subscribe to our 4x a week newsletter to keep up with the insights that matter.