As the final quarter of 2025 unfolds, CIOs and technology leaders find themselves deep in the trenches of year-end planning and 2026 forecasting. While market uncertainty remains, the signals from within the tech leadership community show a story of cautious optimism.

To understand how organizations are preparing for the months ahead, The National CIO Review conducted a community poll asking technology leaders:

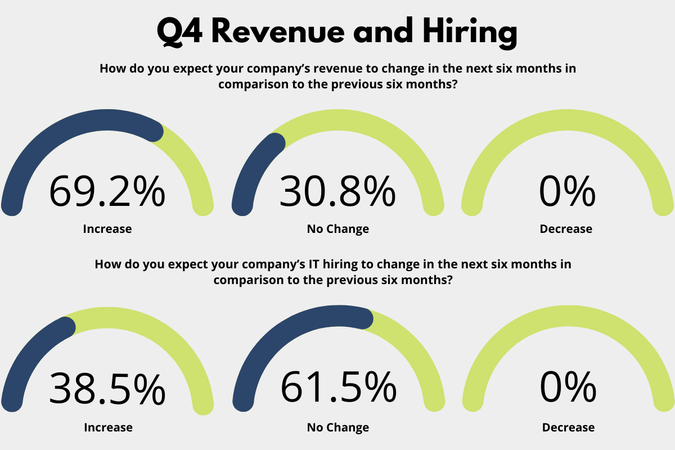

- “How do you expect your company’s revenue to change in the next six months in comparison to the previous six months?“

- “How do you expect your company’s IT hiring to change in the next six months in comparison to the previous six months?“

The results reflect a leadership community that is confident in its growth outlook, yet deliberate and measured when it comes to expanding workforce investments.

Revenue Increase (69.23%)

The overwhelming majority of respondents, nearly 70%, expect their organization’s revenue to increase over the next six months. This indicates a strong sense of momentum among technology executives, many of whom are seeing payoffs from years of digital transformation and innovation-focused investment.

Behind this optimism is the continued demand for scalable, AI-enhanced, and data-driven solutions.

Technology leaders are now driving the business.

This means continued alignment with core business outcomes. IT is expected to enable and accelerate revenue. And while external volatility remains a factor, many leaders appear to be banking on their ability to adapt and capture value faster than the competition.

Revenue No Change (30.77%)

Nearly a third of respondents anticipate no change in revenue over the next two quarters.

While not pessimistic, the stance is potentially shaped by either economic headwinds, cautious customer spending, or market saturation in particular industries.

In these organizations, stability may be viewed as a deliberate outcome itself.

Holding steady can allow for operational tightening or offering realignment without the pressure of chasing top-line growth.

This is often a time to double down on efficiency and optimization.

These leaders are likely refining the digital foundations already in place. That might mean consolidating platforms, modernizing legacy applications, or reallocating resources to initiatives with higher ROI certainty.

The outlook may be flat, but the opportunity to build resilience remains strong.

Revenue Decrease (0%)

Not a single respondent reported an expected decrease in revenue over the next six months.

This is a strong indicator of confidence across the board, particularly given the broader economic troubles that have influenced some sectors.

The absence of revenue pessimism suggests that technology leaders are either seeing sustained demand or are proactively positioning themselves to remain competitive regardless of external conditions.

While individual outcomes may vary, the collective sentiment points to a belief that the worst of the volatility has passed, or at least, that it can be managed effectively.

This offers both validation and responsibility.

Confidence in revenue performance often translates into higher expectations for delivery, innovation, and alignment with enterprise goals. Maintaining that momentum will require continued focus on agility and tactical prioritization.

Hiring Increase (38.46%)

Just over a third of leaders indicated plans to increase IT hiring in the next six months.

This figure, notably smaller than the revenue growth expectation, suggests that many organizations are prioritizing selective, high-impact hiring rather than full-scale expansion.

The disconnect between revenue optimism and hiring acceleration points to a larger trend.

Technology teams are being asked to scale outcomes, not necessarily headcount. With advances in automation and cloud technologies, many CIOs are finding they can do more with less by focusing their hiring plans on specialized skills rather than general capacity.

Where hiring does occur, it’s often tightly aligned to foundational aspects like security, platform engineering, or AI governance.

Hiring No Change (61.54%)

The largest share of respondents, over 60%, expect no change in their IT hiring strategy.

While revenue is suspected to trend upward, this flat hiring outlook suggests a deliberate commitment to stability.

There are several reasons behind this approach.

Some organizations are still digesting earlier hiring waves and are focused on integrating talent and optimizing teams while others are hesitant to expand fixed costs amid uncertain global conditions.

For many, maintaining current staffing levels is a risk-mitigated approach that enables flexibility in execution.

Yet flat hiring does not mean standing still.

These organizations are likely exploring alternative pathways to capability by reskilling internal talent or turning to partners to augment core teams.

CIOs in this category are playing the long game of sustainability over short-term expansion.

Hiring Decrease – 0%

Not a single respondent reported plans to reduce IT hiring in the next six months.

In a year when tech layoffs have made headlines and hiring freezes have emerged in various sectors, this is a powerful sentiment.

The absence of cuts suggests that technology leadership continues to see IT talent as a primary enabler of performance.

Organizations are holding firm onto existing teams, preserving institutional knowledge and avoiding the disruption of churn.

This mindset reinforces the value of IT within the enterprise.

Technology has positioned itself as a long-term asset that demands consistent investment and care, rather than an overhead line item to be cut during turbulence.

The Wrap

The TNCR Q4 community poll provides a unique window into how today’s technology executives are preparing for the months ahead.

A clear majority anticipate revenue growth, yet a smaller cohort plans to increase IT hiring. The prevailing mood is one of measured optimism, where confidence in opportunity is balanced by restraint in execution.

Growth is pursued with intention. Hiring is about acquiring the right skills for what’s next, and stability in headcount is a sign of maturity.

As CIOs finalize their roadmaps and resource models for 2026, this nuanced perspective will serve them well.

While economic tailwinds may shift, ideals of resilience, adaptability, and value-driven leadership remain as vital as ever.

If the poll is any indication, the technology leaders of today are planning for growth, and they are preparing to grow wisely.

Trusted insights for technology leaders

Our readers are CIOs, CTOs, and senior IT executives who rely on The National CIO Review for smart, curated takes on the trends shaping the enterprise, from GenAI to cybersecurity and beyond.

Subscribe to our 4x a week newsletter to keep up with the insights that matter.